Calculating payroll taxes 2023

Subtract 12900 for Married otherwise. 1200000 but does not exceed Rs.

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

2400000 the rate of income tax is Rs.

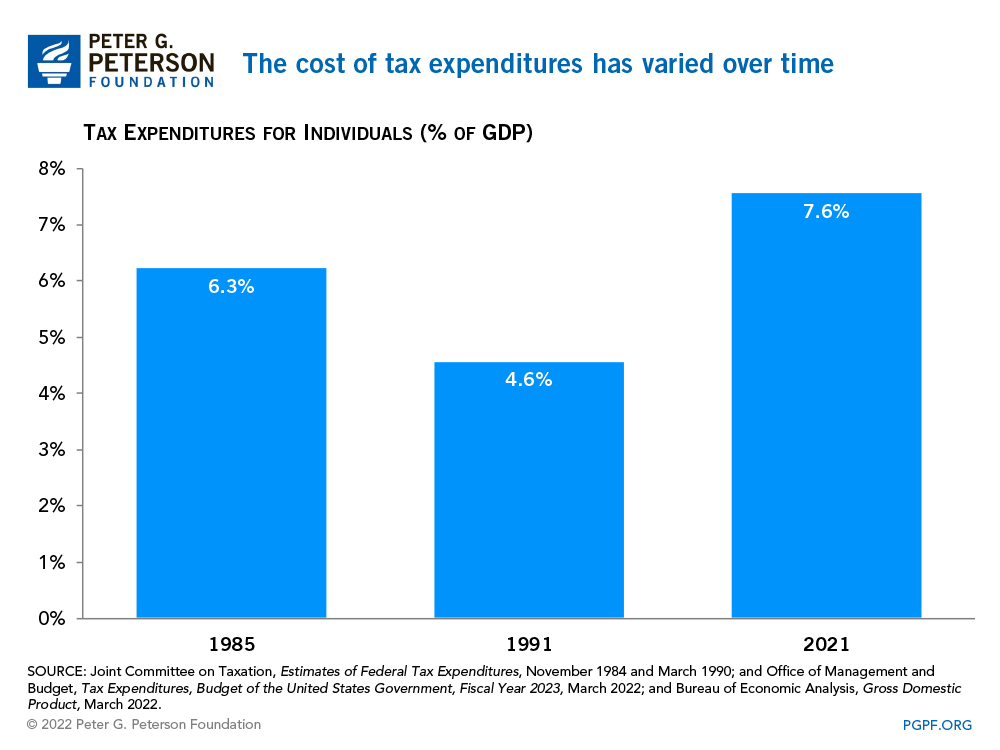

. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. Easily Approve Automated Matching Suggestions or Make Changes and Additions. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment.

Ad Compare This Years Top 5 Free Payroll Software. Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Multiply taxable gross wages by the number of pay periods per. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. If youve already paid more than what you will owe in taxes youll likely receive a refund. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Multiply taxable gross wages by the number of pay periods per. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

If you know your tax code you can enter it or else leave it blank. Payroll Tax Employer Guide. The marginal tax rate is the rate of tax that employees incur.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. See your tax refund estimate.

2022 Federal income tax withholding calculation. Where the taxable salary income exceeds Rs. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents.

Employee portion calculators can be found under Resources on this page. 2022 Federal income tax withholding calculation. The payroll tax rate reverted to 545 on 1 July 2022.

The payroll tax rate reverted to 545 on 1 July 2022. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K. To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above.

Tax is calculated on a gradual diminishing tax-free threshold that gradually phases out between the annual threshold of. Try out the take-home calculator choose the 202223 tax year and see how it affects. 15000125 of the amount exceeding Rs.

Start the TAXstimator Then select your IRS Tax Return Filing Status. The annual threshold is adjusted if you are not an employer for a. Estimate your federal income tax withholding.

242 per week 1048. Its so easy to. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Sage Income Tax Calculator. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

PAYE tax rates and thresholds 2022 to 2023. Calculate how tax changes will affect your pocket. The standard FUTA tax rate is 6 so your.

6 rows For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an. Here are the provisions set to affect payroll taxes in 2023. Well calculate the difference on what you owe and what youve paid.

Subtract 12900 for Married otherwise. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. Free Unbiased Reviews Top Picks.

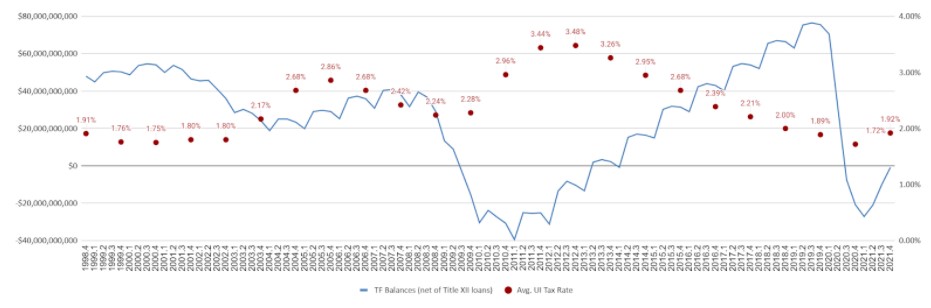

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

California Minimum Wage And California Minimum Salary Thresholds Through 2023 Hrcalifornia

Processing Payroll In Connecticut 2022 Minimum Wage To Final Pay

2022 Federal State Payroll Tax Rates For Employers

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

How Do Marginal Income Tax Rates Work And What If We Increased Them

Processing Payroll In Connecticut 2022 Minimum Wage To Final Pay

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

There S Still Time To Claim The Employee Retention Credit In 2022 Doeren Mayhew Cpas

Biden Budget Biden Tax Increases Details Analysis

2022 Federal State Payroll Tax Rates For Employers

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Federal State Payroll Tax Rates For Employers

Simple Us 2022 Federal Income Tax 2023 Tax Rebate Check Calculator

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com